Preventing the Next DeFi Crisis Through Real-Time Risk Detection Oracles

What happens when a $50B synthetic asset market has no early warning system? With DeFi protocols becoming increasingly interconnected, a single risk event can trigger a chain reaction across the entire ecosystem. That's why @0xBitpulse is building Pulse, DeFi's first decentralized risk oracle, as an Oracle Validated Service (OVS) on the eOracle Stack. Here's how it's transforming the way we detect and prevent systemic risks in DeFi.

Why Traditional Risk Systems Struggle to Keep Up With DeFi?

Well, there are probably many reasons, but let’s cover three CRITICAL challenges have made conventional risk assessment obsolete in the world of synthetic assets:

- Data Complexity: Synthetic assets require multi-dimensional analysis across protocol, counterparty, and market risks

- Network Effects: Risks cascade through interconnected protocols, requiring cross-protocol monitoring

- Speed vs. Accuracy: Risk signals must be both timely and reliable to prevent false positives

How Does ‘Pulse’ Turn Raw Data Into Actionable Risk Signals?

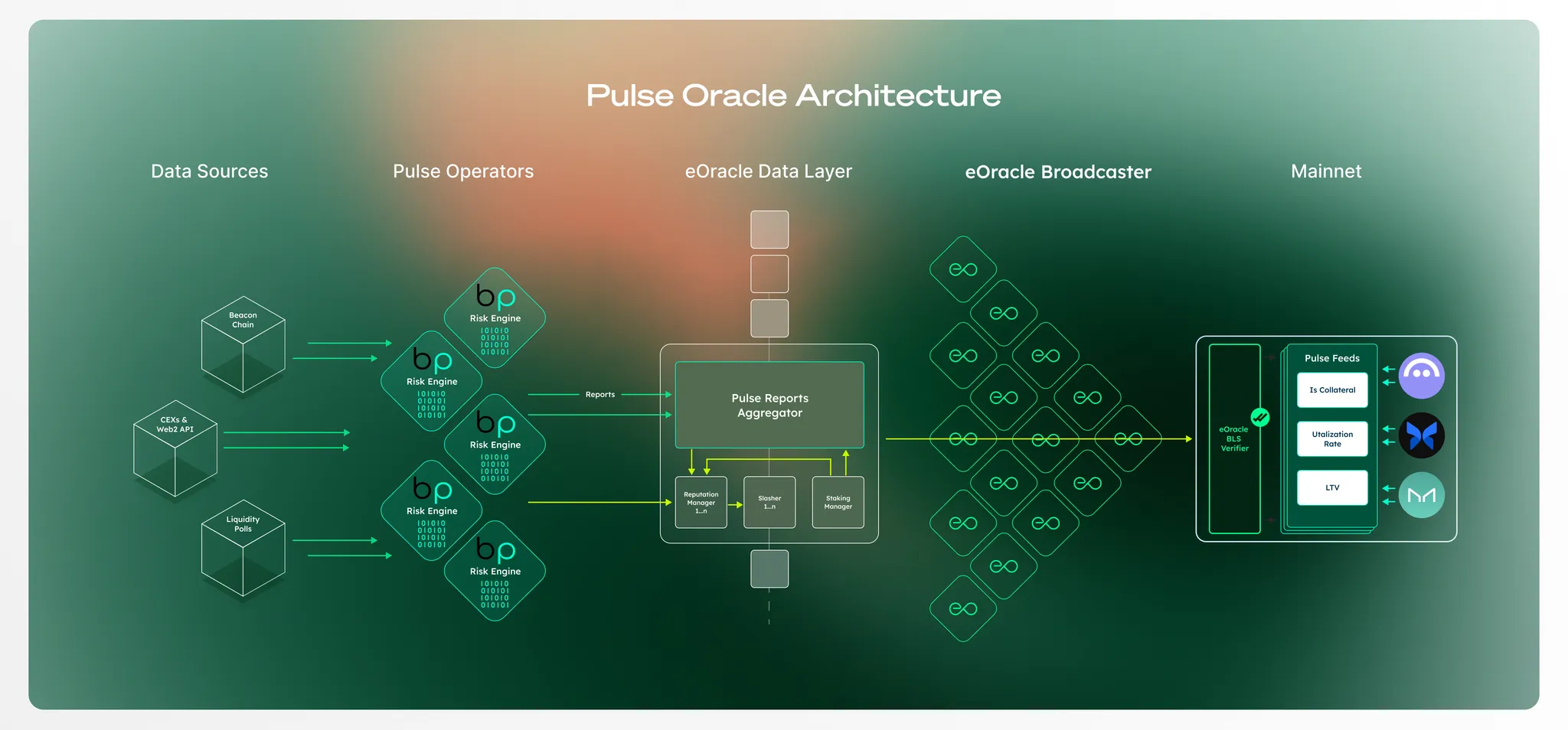

Let's dive deep into Pulse's architecture by answering key questions:

1. Can We Trust Risk Data From a Decentralized Network?

Pulse's specialized validation network solves this through:

- Monitoring multiple data sources including on-chain activity, market data, and protocol states

- Running sophisticated risk models independently across the operator network

- Achieving consensus on risk metrics through eOracle's aggregation mechanisms

- Inheriting Ethereum's security through EigenLayer restaking

This approach ensures no single operator can manipulate risk assessments while maintaining rapid response times.

2. Where Does the Heavy Risk Computation Happen?

Building on eOracle's Immutable Layer, Pulse's computation engine delivers:

- Complex risk calculations off main chains while maintaining cryptographic verifiability

- Custom aggregators for different risk metrics:

- Median-based aggregation for market risk scores

- Threshold consensus for binary risk signals

- Weighted averages for composite metrics

- Auditable trail of all risk assessments and computation steps

3. How Do Risk Signals Reach Different Blockchains?

Through eOracle's Cryptographic Broadcaster, Pulse enables:

- Real-time risk feeds to multiple chains

- Configurable update frequencies based on risk levels

- Efficient batching of risk metrics

- Cryptographic proofs of risk assessments

Here's the full system in action:

What Happens When Risk is Detected?

Here’s how Pulse processes a synthetic asset risk assessment in real-time:

- Data Collection

- How do operators capture the full risk picture?

- Monitor key metrics across protocols

- Validate real-time data against historical patterns

- Map and analyze cross-protocol exposure

- How do operators capture the full risk picture?

- Risk Computation

- What ensures accurate risk assessment?

- Multiple risk models running in parallel

- Asset-specific aggregation methods

- Cross-validation for consistency

- What ensures accurate risk assessment?

- Risk Broadcasting

- How do protocols receive risk alerts?

- Risk threshold-based update triggers

- Signed risk assessments delivery

- Verification-ready risk proofs

- How do protocols receive risk alerts?

Why Build on eOracle Instead of Starting From Scratch?

The decision to build on eOracle Stack wasn't just about speed to market. It enabled Pulse to inherit:

- Battle-tested security infrastructure

- Scalable computation frameworks

- Efficient cross-chain delivery

This foundation allows Pulse to focus on what matters most: developing sophisticated risk models while maintaining institutional-grade reliability.

Why Should Leading Protocols Choose Pulse for Risk Management?

Simply because protocols integrating Pulse gain access to:

- Real-time risk metrics for synthetic assets

- Programmable risk parameters

- Cross-protocol exposure analysis

- Historical risk data and trends

By combining these capabilities, protocols can now detect and respond to risks in minutes rather than hours

What's Next for DeFi Risk Assessment? A Sneak Peek into the Future

As the synthetic asset ecosystem grows, Pulse demonstrates how specialized oracle services can be built on shared infrastructure to solve complex challenges. We're working with leading DeFi protocols to expand our risk coverage and develop new risk assessment methodologies.

Get Involved In Building the Future of DeFi

- Connect with the Bitpulse team: Partnership Form

- Explore building on eOracle: eOracle Stack, https://www.eoracle.io/ovs/

- Join us in building a more resilient DeFi ecosystem through sophisticated, decentralized risk assessment.